Ripple says more than AED 1 billion (over $280 million) of certified polished diamonds held in the United Arab Emirates have been tokenized on the XRP Ledger, in a deal that ties a high-value physical inventory to on-chain issuance, custody, and (eventually) secondary-market rails.

The initiative, announced Tuesday by Billiton Diamond and Ctrl Alt, is pitched as an end-to-end tokenization effort for certified polished diamond inventory in the Dubai market, one that is designed to make provenance, grading, and ownership history verifiable before a transaction, while compressing settlement and operational workflows that have historically relied on offline certification and paper-heavy transfer processes.

XRP Ledger Powers Dubai Tokenization Push

According to the companies’ press release, Ctrl Alt has already tokenized more than AED 1 billion in diamonds, with tokens minted on the XRP Ledger. The partners said the network was selected for “fast settlement, low fees, and scalable architecture,” while the tokenized assets are secured through Ripple’s “enterprise-grade custody technology.”

Reece Merrick framed the move as a proof point that custody and auditability are central to institutional-grade commodity tokenization. “This initiative shows how Ripple’s technology can bridge the gap between physical assets and the digital economy, utilising our enterprise-grade custody solution to secure high-value diamond assets with unrivalled trust and security,” Merrick wrote on X.

He added that the firms were “providing the infrastructure needed to move physical commodities on-chain at scale,” calling it “a significant leap forward for the future of commodities tokenization.” Notably, the firms first announced their partnership in July last year.

Billiton, which the release describes as a leader in rough diamond auctions using a Vickrey auction model, said the collaboration is intended to expand into tokenized polished diamond sales phases. The planned platform would embed real-time inventory management and certification data on-chain, enabling verification of origin, grading, and ownership history before trades.

The firms also pointed to future “secondary market readiness” workstreams: custody, transfer, and market participation, implying the tokens are being structured not just as a digitized record, but as infrastructure for distribution.

The press release said the next stages are subject to regulatory approval by Virtual Assets Regulatory Authority (VARA) prior to launch. That detail matters: the partners are explicitly positioning the effort as compliant market infrastructure, not a one-off proof of concept.

Jamal Akhtar argued the core unlock is liquidity and time-to-cash in a market where diamonds have traditionally been operationally complex to finance and transfer.

“This partnership transforms polished diamonds from a traditionally illiquid asset class into a transparent, investable digital asset that supports manufacturers, brands, and investors alike,” Akhtar said. “Tokenization introduces an unprecedented level of transparency, unlocking the potential for new liquidity, shortening working capital cycles for manufacturers and traders, and opening the door to seamless global participation in Dubai’s growing luxury ecosystem.”

The announcement also credits DMCC with connecting stakeholders and helping build the ecosystem for diamond tokenization, with Ahmed Bin Sulayem describing DMCC as a “bridge between commodities, capital and next-generation digital markets,” and pointing to coordination with VARA as part of the framework underpinning the rollout.

Ctrl Alt’s Robert Farquhar said: “Billiton needed robust, institutional-grade infrastructure to handle the complexity and scale of its polished diamond supply. Our proven tokenization expertise and technology provide a clear, secure, and compliant route for diamond ownership to move on-chain, from asset origination to digital market participation. This establishes a more accessible and operationally efficient model for commodity investment in the UAE.”

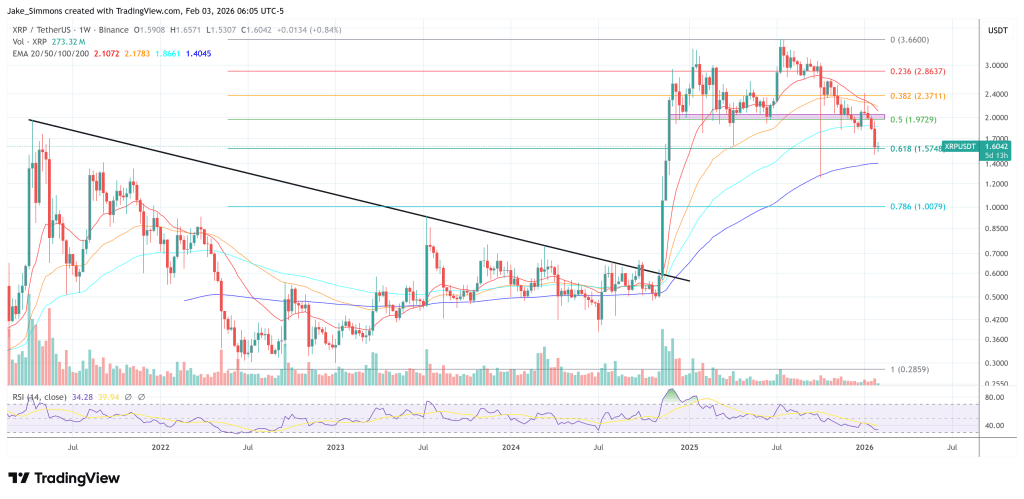

At press time, XRP traded at $1.60.